In contrast, industries with long production cycles or extended credit terms may face longer average collection periods. For instance, construction, manufacturing, and service-based businesses often experience an average collection period between 60 to over 90 days. These organizations need to be more attentive to their collections processes due to the prolonged wait times for payments. On the other hand, businesses that struggle with longer collection periods risk damaging relationships. Late payments impact a company’s cash flow and can create strained communication between the parties involved.

Impact Of Average Collection Period On Your Bottom Line

It can be used as a benchmark to determine if you might need to tighten or loosen your credit policy relative to what the competition might be offering in terms of credit. Comparing the current average collection period ratio to previous years’ ratios shows whether collections improve or worsen over time. For example, you could offer a small discount to customers who pay their bills within a certain period. This strategy can reduce the average collection period, but it may also reduce the total amount you collect, so it’s vital to consider the overall impact on profitability.

Stricter Credit Policies

Furthermore, a lengthier collection period reduces the availability of cash for investment opportunities, whether that’s expansion, R&D, or strategic moves to outperform competitors. Over time, missing these growth opportunities can negatively impact a firm’s market position and profitability. In 2020, the company’s ending accounts delinquent( A/ R) balance was$ 20k, which grew to$ 24k in the posterior time. To get the average collection period for any entity, just input the numbers into the equation below. HighRadius’ AI-powered collections software helps prioritize worklists for the top 20% of customers and automates collections for 80% of long-tail customers. This results in a 20% reduction in past-due accounts and a 30% increase in collector productivity.

- There can be significant variations in the average collection period from one industry to the next.

- By keeping track of this period, businesses can make informed decisions regarding their credit terms and collection processes to ensure a healthy balance sheet and maintain a smooth cash flow cycle.

- Most of the time, this signals that the management has prioritized investment in collections and improved the collections processes.

How average collection period affects cash flow

It stands as an essential financial metric that grants businesses insight into the speed at which they can convert credit sales into actual cash. In today’s business landscape, it’s common for most organizations to offer credit to their customers. After all, very few companies can rely solely on cash transactions for all their sales. If your business follows suit by extending credit to customers, it becomes crucial to efficiently manage payment collections. When a company sets strict credit terms, it may deter potential clients who prefer more lenient payment schedules. Conversely, overly generous credit terms might attract customers looking to capitalize on favorable payment conditions.

Accounts Receivable (AR) Turnover

A low ACP implies that the organization is collecting payments more quickly from its customers, allowing it to generate cash sooner and reduce the risk of bad debts or aging receivables. However, lower collection periods might also suggest stricter credit terms or an emphasis on quick payment processing. In turn, a shorter CCC signifies that the business can convert inventory into sales faster while collecting those receivables efficiently. It is essential for organizations to consistently monitor their average collection period and adapt their credit policies accordingly. By doing so, businesses can respond to industry trends, customer preferences, and economic conditions that may impact their receivables management practices. Regularly reviewing the average collection period enables companies to make informed decisions, optimize their collections processes, and maintain a positive relationship with their clients.

Compared to Current Credit Terms

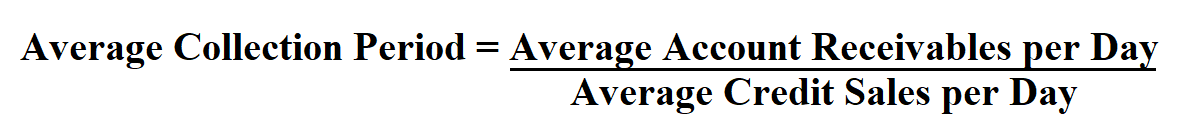

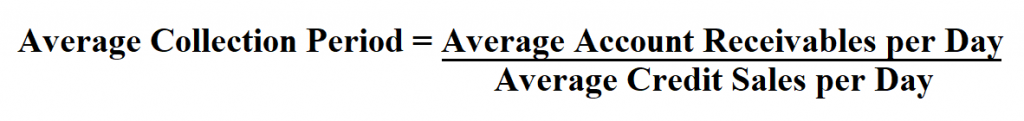

Plus, the impact is greater for professional service companies, as you don’t have physical assets or products to fall back on to recuperate those losses. The average collection period is the average number of days it takes for a credit sale to be collected. While a shorter average collection period is often better, too strict of credit terms may scare customers away. In order to calculate the average collection period, divide the average balance of accounts receivable by the total net credit sales for the period. The average receivables turnover is simply the average accounts receivable balance divided by net credit sales; the formula below is simply a more concise way of writing the formula. If your company relies heavily on receivables for cash flow, the average collection period ratio is an especially important metric.

As stated before, having a shorter collection period is generally better as it indicates faster cash flow. Having an average collection period of 30 days is just about average, so the company is barely getting paid on time. CCC is calculated as the sum of the average collection period and the inventory turnover period (days to sell inventory). Understanding both ACP and CCC together can provide valuable insights into a company’s working capital management and overall financial health. Understanding industry benchmarks and comparisons is vital in evaluating the performance of an organization’s average collection period. By analyzing this metric across different industries, businesses can identify best practices and trends for managing their accounts receivable effectively.

It allows the business to maintain a good level of liquidity which allows it to pay for immediate expenses. It also allows the business to get a good idea of when it may be able to make larger, more important purchases. According to a PYMNTS report, 88% of businesses automating their AR processes see a significant reduction in their DSO. Automation can also help reduce manual intervention in collection processes, enabling proactive communication with customers and helping establish appropriate credit limits.

The ratio is interpreted/counted in days and can be computed by multiplying the ACP by the number of days in a given period. On the contrary, a company with a long collection period might prepaid expenses meaning journal entry and examples be offering more liberal credit terms or might not be enforcing its collections process strictly. This could indicate potential issues within the credit department that need addressing.

If Company ABC aims to collect money owed within 60 days, then the ACP value of 54.72 days would indicate efficiency. However, if their target collection period is 30 days, the ACP value of 54.72 days would be too high, indicating inefficiency in the company’s collection efforts. To better illustrate how this formula works, let’s assume Rosie Dresses has a beginning balance in AR of $890,000, an ending balance of $780,0000, and annual sales of $2,650,000. Accordingly, the average AR will equal $890,000 plus $780,000 divided by two or $835,000.