This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced. Such fixed costs are not considered in the contribution margin calculations. The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products.

Total Contribution Margin

For instance, if a product has a high contribution margin, it might justify a higher selling price, while products with lower margins might need cost reductions or even discontinuation. Yes, the Contribution Margin Ratio is a useful measure of profitability as it indicates how much each sale contributes to covering fixed costs and producing profits. A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs. The concept of this equation relies on the difference between fixed and variable costs. Fixed costs are production costs that remain the same as production efforts increase.

- Understanding how each product, good, or service contributes to the organization’s profitability allows managers to make decisions such as which product lines they should expand or which might be discontinued.

- Find out what a contribution margin is, why it is important, and how to calculate it.

- They also use this to forecast the profits of the budgeted production numbers after the prices have been set.

- Investors and analysts may also attempt to calculate the contribution margin figure for a company’s blockbuster products.

Example: contribution margin and target profit

The greater the contribution margin (CM) of each product, the more profitable the company is going to be, with more cash available to meet other expenses — all else being equal. If the company realizes a level of activity of more than 3,000 units, a profit will result; if less, a loss will be incurred. Along with the company management, vigilant investors may keep a close eye on the contribution margin of a high-performing product relative to other products in order to assess the company’s dependence on its star performer. Another common example of a fixed cost is the rent paid for a business space.

Implementing Contribution Margin Analysis in Small Businesses

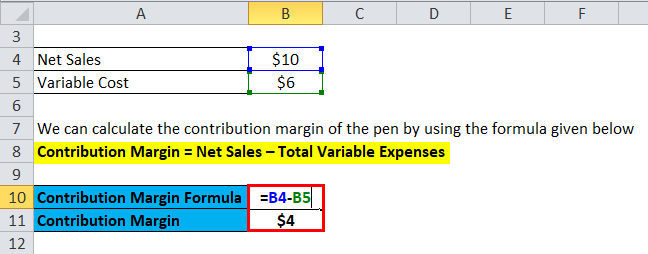

Calculate the total contribution margin ratio by dividing the total of all contributions you calculated in Step 2 by the total sales revenue from Step 1 (you have to have both numbers to calculate this). In accounting, contribution margin is the difference between the revenue and the variable costs of a product. It represents how much money can be generated by each unit of a product after deducting the variable costs and, as a consequence, allows for an estimation of the profitability of a product. To master cost-behavior analysis, business leaders employ a variety of techniques.

Why are contribution margins and contribution margin ratios important to you?

A contribution margin ratio of 40% means that 40% of the revenue earned by Company X is available for the recovery of fixed costs and to contribute to profit. Here, the variable costs per unit refer to all those costs incurred by the company while producing the product. These include variable manufacturing, selling, and general and administrative costs as well—for example, raw materials, labor & electricity bills. Variable costs are those costs that change as and when there is a change in the sale.

Contribution Margin Vs Gross Margin

It is the monetary value that each hour worked on a machine contributes to paying fixed costs. You work it out by dividing your contribution margin by the number of hours worked on any given machine. A contribution margin analysis can be done for an entire company, single departments, a product tax day party line, or even a single unit by following a simple formula. The contribution margin can be presented in dollars or as a percentage. Let us understand the formula that shall act as a basis of our understanding of the concept of per unit contribution margin through the discussion below.

In May, \(750\) of the Blue Jay models were sold as shown on the contribution margin income statement. When comparing the two statements, take note of what changed and what remained the same from April to May. For example, assume that the students are going to lease vans from their university’s motor pool to drive to their conference. A university van will hold eight passengers, at a cost of \(\$200\) per van. If they send one to eight participants, the fixed cost for the van would be \(\$200\). If they send nine to sixteen students, the fixed cost would be \(\$400\) because they will need two vans.

You may also look at the following articles to enhance your financial skills. When there’s no way we can know the net sales, we can use the above formula to determine how to calculate the contribution margin. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.