As you will learn in Corporation Accounting, there are three components to thedeclaration and payment of dividends. The first part is the date ofdeclaration, which creates the obligation or liability to pay thedividend. The second part is the date of record that determines whoreceives the dividends, and the third part is the date of payment,which is the date that payments are made. Printing Plus has $100 ofdividends with a debit balance on the adjusted trial balance. Theclosing entry will credit Dividends and debit RetainedEarnings. Thebalance in the Income Summary account equals the net income or lossfor the period.

What Is Net Income?

While they tend to be similar and repetitive, it is worth having a good understanding of what entries are being made and why they are being made. Closing entries help in the reconciliation of accounts which facilitates in controlling the overall financials of a firm. All accounts can be classified as either permanent (real) ortemporary (nominal) (Figure5.3).

Common Checklist Categories & Tasks

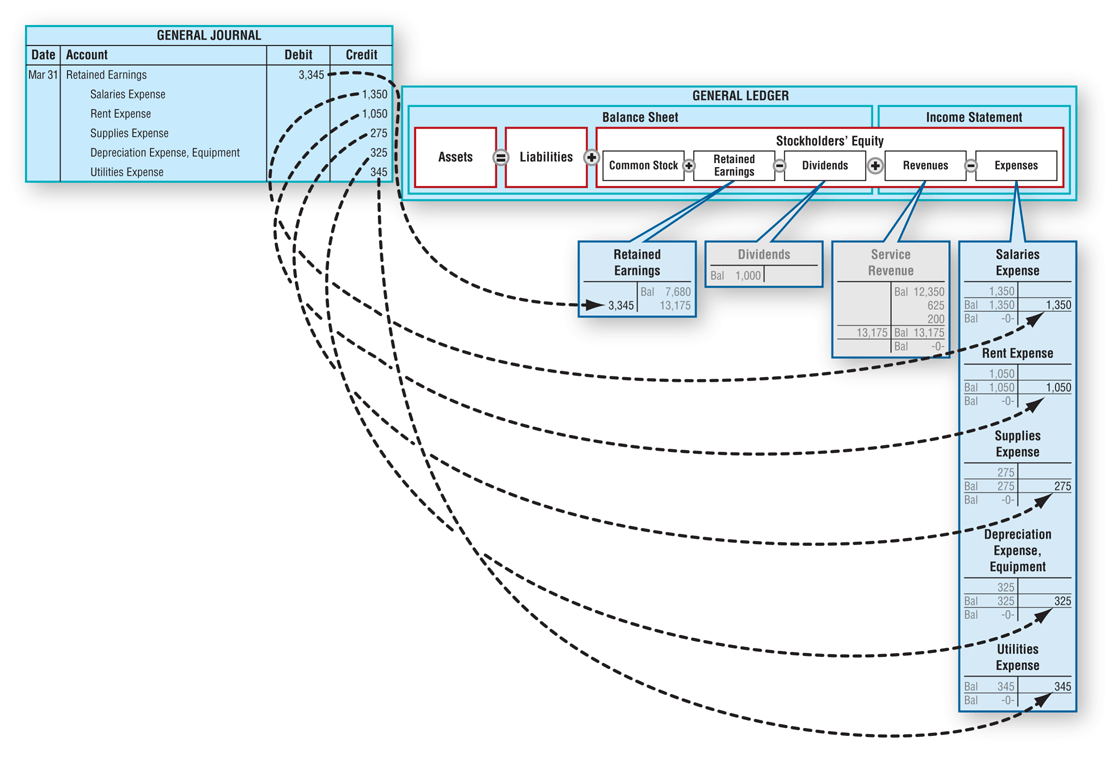

These permanent files include assets, liabilities and equity sections making them very useful in showing the company’s financial position that lasts long. In short, we can clear all temporary accounts to retained earnings with a single closing entry. By debiting the revenue account and crediting the dividend and expense accounts, the balance of $3,450,000 is credited to retained earnings. Closing entries, also called closing journal entries, are entries made at the end of an accounting period to zero out all temporary accounts and transfer their balances to permanent accounts. In other words, the temporary accounts are closed or reset at the end of the year. Temporary accounts are used to compile transactions that impact the profit or loss of a business during a year, while permanent accounts maintain an ongoing balance over time.

Closing Entry Definition, Types & Examples

The fourth entry requires Dividends to close to the RetainedEarnings account. Companies are required to close their books at the end of eachfiscal year so that they can prepare their annual financialstatements and tax returns. However, most companies prepare monthlyfinancial statements and close their books annually, so they have aclear picture of company performance during the year, and giveusers timely information to make decisions. Thebusiness has been operating for several years but does not have theresources for accounting software. This means you are preparing allsteps in the accounting cycle by hand.

- Creating closing entries is one of the last steps of the accounting cycle.

- Do you want to learn more about debit, credit entries, and how to record your journal entries properly?

- These accounts are closed directly to retained earnings by recording a credit to the dividend account and a debit to retained earnings.

- The $9,000 of expenses generated through the accounting period will be shifted from the income summary to the expense account.

- RetainedEarnings is the only account that appears in the closing entriesthat does not close.

Next, transfer the $2,500 in your expense account to your income summary account. First, transfer the $5,000 in your revenue account to your income summary account. Whether you credit or debit your income summary account will depend on whether your revenue is more than your expenses. Because expenses are decreased by credits, you must credit the account and debit the income summary account.

In which journal are closing entries typically recorded?

Accounts can be closed on a monthly, quarterly, semi-annual or annual basis. It is really determined by a company’s need for financial reporting. Most companies close on a monthly or annual basis but that isn’t to say it is uncommon to see a quarterly or semi-annual close. They are special entries posted at the end of an accounting period.

The purpose of closing entries is to merge your accounts so you can determine your retained earnings. Retained earnings represent the amount your business owns after paying expenses and dividends for a specific time period. In this example we will close Paul’s Guitar Shop, Inc.’s temporary accounts using the income summary account method from his financial statements in the previous example.

Finally, you are ready to close the income summary account and transfer the funds to the retained earnings account. You need to create closing journal entries what are t accounts definition and example by debiting and crediting the right accounts. Use the chart below to determine which accounts are decreased by debits and which are decreased by credits.